EVERYTHING YOU WISH TO KNOW ABOUT OALP BID ROUND

OALP ROUNDS

The Open Acreage Licensing (OAL) was introduced in July 2017. The present exploration licensing round has come after a gap of seven-eight years. The last round took place in 2010 under the then existing licensing policy NELP. In the Open Acreage Licensing Policy (OALP), the investors are allowed to carve out their own areas and submit the EOIs for the same. These blocks are then put on bidding in which other companies can also participate. The Bidder company should, however, have (i) one-year operatorship experience in exploration, development or production of Oil, Gas or CBM (ii) either had acreage or producing assets and (iii) the required financial net worth.

In Round – I , 55 blocks covering nearly 60,000 sq. km. have already been awarded and contracted with six E&P Companies in October 2018. In Round- II, 14 blocks covering 30,000 sq km (approx) were put on bidding based on EOIs received and the Government’s review. And subsequent bidding rounds come now every four to six months. The companies can carve out areas of their choice and submit EOIs.

BACKGROUND:

INDIA OPENS ALMOST ENTIRE SEDIMENTARY AREAS FOR OIL HUNT

On July 1, 2017 India commenced the first bidding round for oil and gas through an open acreage licensing program (OALP), allowing bidders to select where they want to drill. It also launched National Data Repository (NDR) which offers 160 terabytes of data on India’s 26 sedimentary basins; the vast data collected over last six decades by E&P companies and other agencies.

The interested parties can submit their expressions of interest (EoIs) for a particular area. That window will be open for three to four months or till November. Then the EoIs will be evaluated and bids invited. The blocks are likely to be awarded by the end of January 2018. The contract will be under new Hydrocarbon Exploration Licensing Policy (HELP).

The success of recently concluded Discovered Small Fields Bid Round under HELP has given confidence to the Government to come out with the auction of large exploration acreages also under the new policy.

India is now puting 90% of entire sedimentary areas in the country for a pick by investors under the Open Acreage Licensing Policy (OALP). OALP is a clear departure from the current licensing policy of government identifying the oil and gas blocks and then putting them on auction.

Under OALP, the bidders will have the choice of either a Reconnaissance Contract only for probing for Hydrocarbon or Petroleum Operations Contract for exploration, development, and production. The reconnaissance contract will be valid for three years and the petroleum operations contract will allow eight years for exploration and 20 years for development and production. There will also be an option to migrate from a reconnaissance contract to a petroleum operations contract after three years.

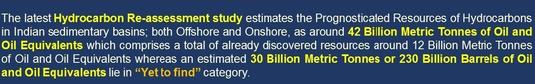

Out of India’s total sedimentary area of 3.14 million square kilometers spread over 26 sedimentary basins, the present offer is for 2.7 million square km, almost 90%. This comprises of 1.5 million square km of onshore and 1.2 million square km of offshore area. Presently, oil and gas production in India is only from 7 sedimentary basins. Half of sedimentary basins has remained unexplored. A sedimentary basin is an area in the Earth’s crust in which sediments have accumulated. Petroleum mainly occurs in sedimentary basins but need to be explored.

Investors will get access to the National Data Repository that offers 160 terabyte information on 26 sedimentary basins. In the NDR, sedimentary basins gridded into sectors and divided into zones with corresponding data are made available. The NDR is based on seismic and well data, and investors can identify areas with potential through this. About 100 companies, including some international oil explorers, have purchased data for the different sedimentary basins.

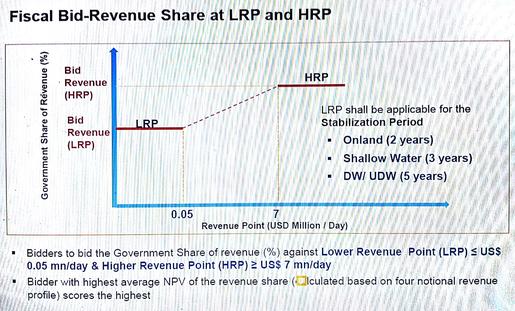

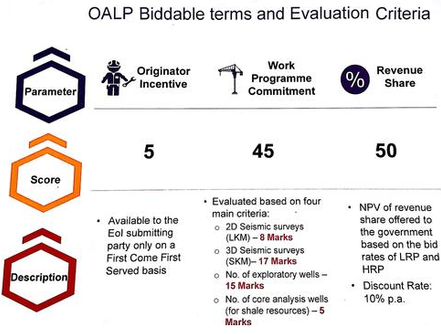

After studying the geological data, a prospective bidder can carve out blocks of his choice submit an expression of interest for the same. The block then will be put on auction. This prospective bidder will have to compete with other bidders in the auction though he gets a small additional weight vis-à-vis competitors during the technical evaluation process. The financial bids will be evaluated on the basis of revenue share offered to the Government and committed biddable Minimum Work Program, both caring equal weights. 51 expressions of interest (EoI) covering about 60,000 square kilometers have been submitted so far by domestic and foreign companies.

The auction of oil and gas blocks will be conducted twice a year, with the first round will be held in December this year.

A company or consortium of companies can bid. There are no technical qualification criteria for Reconnaissance Contract. But for bidding for Petroleum Operations Contract, the Bidder company must have one-year operatorship experience in exploration, development or production of Oil, Gas or CBM plus the required financial net worth.

The bidding will be under HELP, replacing NELP, the existing licensing policy under which 254 exploration blocks were awarded since 1997. This would be a major reform and may bring a sea-change in Oil Sector.

First, under HELP, the contractors will get a uniform license for exploration and production of all forms of hydrocarbon during the entire contract period. The uniform license will enable the contractor to explore conventional as well as unconventional oil and gas resources including CBM, shale gas/oil, tight gas, and gas hydrates under a single license. This makes a departure from the NELP wherein separate licenses were required for different types of hydrocarbons. As a result, contractors could not exploit the unconventional hydrocarbons even if found within the block, for want of the specific license. Now, the contractors will not need separate licenses for Oil, Gas, CBM, Shale Oil, Tight Gas etc.

Second, the contractors will have full right to continue exploration during entire contract period; earlier it was limited to exploration phase only. This will enable full exploitation of the block through further exploration and discovery.

Third, the next paradigm shift is from the complex cost profit- model to a simple revenue sharing with the Government In past, the profit sharing led to delays and disputes with the government scrutinizing cost details of private participants. In the revenue sharing contract, the contractor will not have to obtain government approval for incurring expenses. It will reduce administrative burden and ensure faster decision making and speedy project implementation.

The new model will replace the controversial production-sharing contract (PSC) that has governed the bidding under nine earlier NELP rounds. The PSC regime, which allows operators to recover all investments made from the sale of oil and gas before profits are shared with the government, was criticized by India’s official auditor, who said it encouraged companies to keep inflating costs so as to postpone sharing of profits.

Fourth, the operators will have the freedom to sell oil and gas at arm’s length market prices.

Fifth, other incentives include no cess on the oil production, customs duty exemptions and also reduced royalty structure for offshore blocks.

The July auction will be India’s major exploration licensing round after a gap of seven years. The previous major round under NELP-IX took place in 2010 besides recent award of 44 small discovered fields mainly to 22 companies.

With the successful testing of the new Hydrocarbon Exploration Licensing Policy (HELP) in Discovered Small Field Round, the upcoming auction is expected to get an overwhelming response from both domestic and international companies.

OPAL ROUND- I

INDIA OPENS ALMOST ENTIRE SEDIMENTARY AREAS FOR OIL HUNT

Vedanta Cairn, India’s second largest producer of Oi & Gas, emerged the biggest winner of the exploration blocks, bagging three-fourth of blocks put on auction. Out of 55, it was awarded 41. It had placed bids for all the 55 blocks. Vedanta believes there’s a lot to unfold in the Indian geology. Its aggressive bidding reconfirms its confidence in Oil & Gas Sector. Cairn is globally known for its exploration expertise and may become a game changer for Indian oil and gas scenario.

The second winner is Oil India with 9 blocks, followed by ONGC with 2 blocks and GAIL, BPRL, and HOEC- one each.

The Government had invited bids for 55 blocks under Open Acreage Licencing Policy (OALP). The list of Awardees was released by the Government on the 28th August 2018 and the contracts between the Government and the Awardees was formally signed on 1st Oct, 2018.

The investment in exploration and drilling activities are likely go up substantially in coming years. For example, Vedanta Cairn has committed capital expenditure of US$550 million on the awarded blocks over a period of approximately three to four years.

Trustworthy provides Domain Expert Services to Investors for

Selection of best acreage for RC or POC

Review and interpretation of existing data at NDR

Need-based optimal survey selection and parameter design

Preparation of Tender document for best service provider selection

Quality Control during execution of survey

Processing and Interpretation of acquired data

Recommendation for future course of action

How will India's oil and gas auction perform?*

India, the world’s third-largest importer of crude oil, launches its first oil and gas auction after eight years on January 18. The timing is apt with the significant recovery in oil price which has hit a 3-year high mark touching $70 per barrel.

Last year, India had invited Expression of Interest (EoI) under the Open Acreage Licensing (OAL) in July 2017. In OAL, the companies are allowed to carve out their own areas and submit the EOIs for the same. In all, 55 expressions of interest were received in the first round which closed on November 15.

These 55 Blocks are now put on competitive bidding in which other companies can also participate. The Notice Inviting Offer (NIO) has been issued on January 19 and will be closed on May 2. The blocks are likely to be awarded by July-August, 2018.

Out of 55 EoIs received during July-Nov 2017, 41 were from ONGC and Cairn, the two largest Oil and Gas producers in India and remaining from Oil India, HOEC, and others. But the Global giants such as ExxonMobil, Shell, BP, TOTAL, PETRONAS, or Eni and Domestic companies like Reliance did not submit EoI for any area.

Given this background, can we expect a good response and participation in the bidding for the blocks? Let us take a close look on the factors which may influence the level of investors’ participation in the bidding.

First, oil price is now on an upward trend. Brent, which had fallen from $115 in June 2014 to $26 a barrel in January 2016, has gained by 17% during 2017. Oil price is trading near its highest level since 2015. Investment climate in the oil sector is expected to improve in the current year.

Second, the present exploration licensing round has come after a gap of eight years. The last round took place in 2010 under the then existing licensing policy NELP. The government had awarded 254 exploration blocks were awarded in nine rounds of bidding between 1997 and 2010. Since then, the industry has been waiting for the next auction round.

Third, India had put almost 90% of entire sedimentary areas for a pick by investors. Its National Data Repository (NDR) made available 160 terabytes of data on India’s 26 sedimentary basins spread over 2.7 million square km. The prospective investors had online and offline access to the vast data collected over last six decades by E&P companies and other agencies. After studying the geological data, the prospective bidders selected the blocks where they want to explore and drill. These 55 blocks cover only 60,000 square km out of 2.7 million square km, a small fraction. It appears blocks only with the high potential acreages have been shortlisted and chosen by the companies.

Four, the blocks will be awarded under new Hydrocarbon Exploration License Policy (HELP), more liberal than the old policy, NELP. The contractors get full right under a single license for the entire contract duration to explore both conventional and unconventional oil and gas resources, including coal bed methane, shale gas and oil and gas hydrates with the pricing and marketing freedom. The new license marks a shift to a simple revenue-sharing model from the complex and controversial cost-recovery model. These changes make the participation in bidding more attractive. HELP has been successfully tested in Discovered Small Field Round last year.

Fifth, under the OAL, the Expression of Interest for any acreage was accepted on first- come- first-served basis and area got blocked and other companies, even while interested, could not submit EoI for the same acreage. But now the blocks are put on the competitive bidding in which any company with required one-year operatorship experience in exploration, development or production of oil, gas or CBM having the required financial net worth can participate.

So, a wider participation can be expected.

* First Published in ET Energy World on January 16, 2018.(updated on April 2, 2018)

EVERYTHING YOU WISH TO KNOW ABOUT OALP BID ROUND

India had earlier invited EOI under Open Acreage Licensing (OAL) in July 2017. In OAL, the investors were allowed to carve out their own areas and submit the EOIs for the same. In all, 55 valid expressions of interest were received from six companies.

These blocks are now put on bidding in which other companies can also participate.

The Bidder company should have (i) one-year operatorship experience in exploration, development or production of Oil, Gas or CBM (ii) either had acreage or producing assets and (iii) the required financial net worth.

The Bidding opened on January 19. The last date of Bidding which was earlier April 3 has been extended till May 2. It is reported that six more companies have shown an interest in these blocks and the foreign players from the US, Canada, and Singapore sought more time.The last date for submission of bids has been accordinly extended to encourage participation by more players. The blocks are likely to be awarded by July- August, 2018.

The 55 blocks on offer covers around 60,000 sq. km. across 10 basins.The Geoscientific Information about the Blocks and Tender Documents may be seen at http://online.dghindia.org/oalp/tender

The blocks will be awarded under new Hydrocarbon Exploration License Policy (HELP), more liberal than the old policy, NELP.

The contractors get full right under a single license for the entire contract duration to explore and produce both conventional and unconventional oil and gas resources, including coal bed methane, shale gas and oil and gas hydrates with the pricing and marketing freedom. The new license marks a shift to a simple revenue-sharing model from the complex and controversial cost-recovery model.

The liberal terms make the participation in bidding more attractive.