India pushes Compressed Bio Gas (CBG):

1. Compressed Bio Gas (CBG), a clean energy from waste has mostly remained unexploited.

2. CBG brings a simple solution to keep cities clean, reduce pollution and generate green energy.

- CBG contains around 90% methane, also known as bio-CNG is an alternative to CNG for transportation sector and a clean fuel for domestic and industrial production including electricity generation.

- Bio-manure, a by-product, from CBG plants is used in agriculture as Fermented Organic Manure.

- CBG can effectively contribute to enhancing the share of natural gas in India’s primary energy basket which currently stands at around 6.5 per cent as against the Global average of 24%. India has a target of 15% by end of this decade.

- A medium size plant processes organic waste of 100 Ton/day producing 5 Ton CBG and 30 Ton Organic manure daily.

- The Sustainable Alternative Towards Affordable Transportation (SATAT) scheme offers various incentives for example subsidy on plants, lending by banks and gas marketing tie-up with Oil and Gas Marketing Companies.

- RBI has included CBG plants under the priority sector lending category. Recently, Asia’s largest Bio-CNG plant in Indore has been funded by HDFC Bank under its ESG commitments. PSU Banks such as SBI, PNB, Canara Bank, UBI, and Bank of Baroda have also launched products on financing of CBG projects.

- Oil and Gas Marketing Companies such as IOCL, BPCL, HPCL, GAIL and IGL are executing long term agreements to procure CBG from the plants.

- India has a big target of five thousand plants in coming years. But only 40 CBG plants have been put into in operation, not even 1% of the target. Entrepreneurs with equity capital are yet to give a boost to this sector.

- Like achieving any Big Dream, it however requires focused efforts addressing challenges relating to CBG industry such as uninterrupted supply of bio- waste, developing market for the bio-manure, and CBG pricing.

ONGC’s largest offshore oil field, Mumbai High is producing continuously since almost five decades. It achieved peak production of 4.7 lakhs barrel oil per day in 1985. Production since then is declining. Currently producing 1.5 lakhs bopd.

ONGC has been doing redevelopment in phases to arrest the declining trend.

The field is spread over2000 square km in Mumbai offshore in the Arabian Sea. Mumbai High holds 14 billion barrels of oil initially in place (OIIP).

Recovery till date has been below 30%. Higher recovery is possible.

ONGC is looking for international expertise for

improving recovery and production performance

CBM OUTLOOK

India Launches Special CBM Bid Round – II

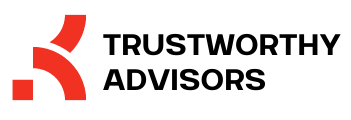

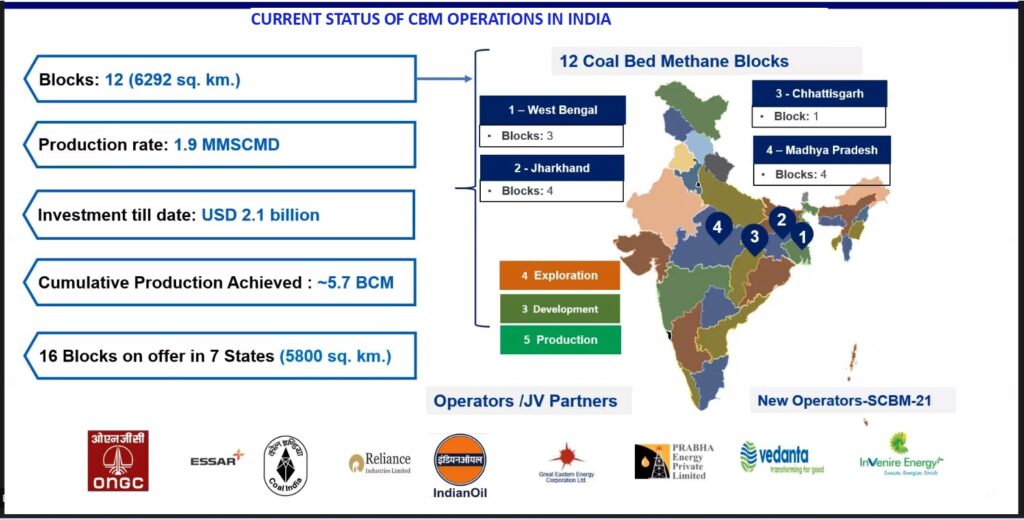

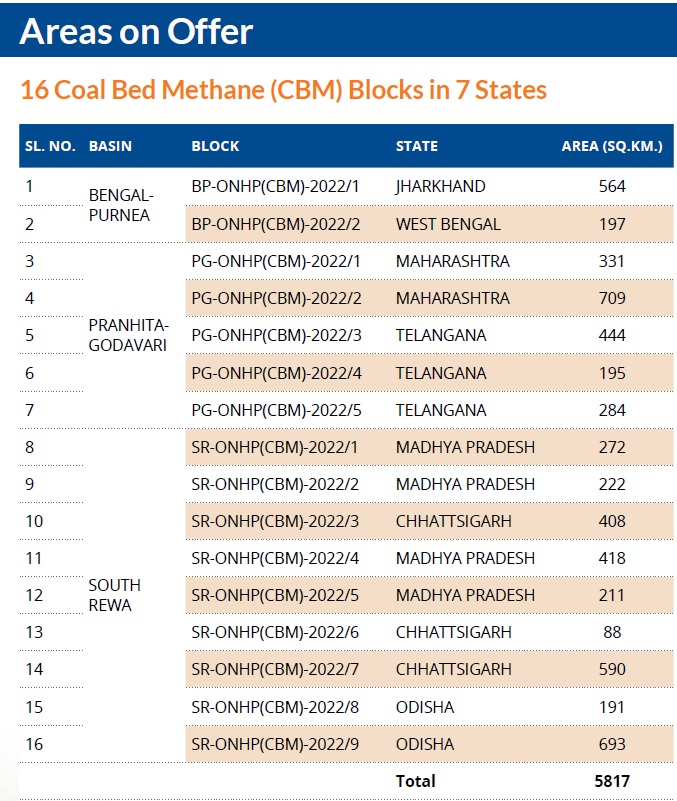

1. After recent award of 4 CBM (Coal Bed Methane) Blocks in previous bid round, the Government has put 16 CBM Blocks under International Competitive Building.

2. The offer comes with the liberal terms under new HELP and CBM Policy that make investing in CBM more attractive.

3. No revenue to be shared with the government till windfall gain (annual revenue exceeds $2.5 billion).

4. Full Marketing and Pricing Freedom for Gas produced.

5. Recent hike in Gas price Availability of Gas Pipeline infrastructure around the Blocks has made investment in CBM Industry more attractive.

6. Prior experience in Oil and Gas sector NOT mandatory. This makes entry of fertilizer, steel and other gas-based units into CBM production possible.

7. 100% participation from foreign companies/Joint ventures allowed.

8. Pre- Bid Conference on 16th December 2022 and Bidding is in progress and closes on 30th June 2023.

9. CBM in India is currently being produced by ONGC, Essar, Reliance, and Great Eastern Energy. In the last bidding round, Vedanta- Cairn and Invenire Petrodyne also won CBM Blocks besides ONGC.

UNLOCKING COAL BED METHANE (CBM) POTENTIAL IN INDIA: GROWING OPPORTUNITIES

With the recent announcement of liberalized regulations and policies for Coal Bed Methane (CBM), the activities will pick up in the fields for its exploration and production. This enhances investment opportunities in the CBM Industry in India.

The state-run miners, the Coal India and its Subsidiaries, can now explore and produce Coal Bed Methane (CBM) from areas under Coal Mining Lease allotted to them. No separate license/lease is required for extraction of Coal Bed Methane (CBM) under their Coal Bearing Areas. This exemption has been given by the Government of India by amending provisions of its earlier notification. This removes one of main obstacles in development of CBM in India.

The progress in CBM so far has remained slow. India has a coal reserve of 285 billion tonnes, the world’s fourth-largest coal reserves. CBM, a natural gas which contains 90-95% methane, is stored or absorbed in coal seams and thus holds significant prospects for exploration and exploitation of CBM.

Despite the huge reserves, a mismatch exists between estimated resources and CBM gas in-place. It has CBM Prognosticated Resource of 63 TCF. Of this, in-place reserves have been established at 9.9 TCF in 6 blocks- 2 each in Jharkhand, West Bengal and MP states.

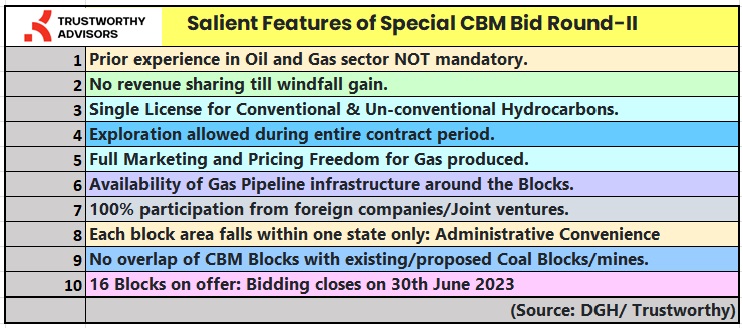

Though, 33 CBM blocks were awarded to different public sector and private companies through four rounds of bidding between 2001 and 2008, only four blocks have gone into commercial production. 9 Blocks are in Exploration or Development phase. The remaining allotted blocks have either been relinquished or likely to be relinquished. In last 10 years, no bidding round took place. Some of the reasons for slow growth has been coal bed methane areas overlapping with coal blocks, delay in land acquisition and statutory clearances, water handling problems and lack of gas infrastructure in CBM blocks.

CBM is currently produced from only four blocks viz. Jharia block in Jharkhand by ONGC, Raniganj East in West Bengal by Essar Oil Ltd, Raniganj South in West Bengal by Great Eastern Energy Corporation and Sohagpur West in Madhya Pradesh by RIL. Last year, they together produced around 735 million standard cubic metres (MMSCM) of CBM, compared to 393 MMSCM in 2015-2016, an impressive 85 per cent jump in two years.

To reduce the gap between demand and supply of gas, the share of CBM in total gas production is targeted to be raised to 5 per cent from the current around 3 per cent. The liberalized regulations and policies relating to CBM are expected to make investment in CBM attractive.

First, in March 2017, the government’s new policy provided marketing and pricing freedom at arm’s length price in the domestic market to contractors of CBM blocks. As a result, CBM fetches higher price than the government- formula based natural gas price. Recently, Essar Oil and Gas Exploration and Production (EOGEPL) invited bids from prospective buyers of gas and was able to discover the CBM price which is more than double of formula based the natural gas price. GAIL committed to purchase Essar’s entire production of CBM from a West Bengal block for the next 15 years.

Second, under new Hydrocarbon Exploration License Policy (HELP), the contractors get full right under a single license for the entire contract duration to explore and produce both conventional and unconventional oil and gas resources, including coal bed methane, shale gas and oil and gas hydrates. No separate license is needed for exploration and production of CBM.

Third, similarly, Coal India and its subsidiaries holding Coal Mining Lease will not have to make fresh application to the Petroleum Ministry under the P&NG Rules 1959 for grant of Mining Lease (ML) for CBM. This removes a major retarding force in development of CBM in India.

In short, the liberal terms make the investing in CBM more attractive. The Industry leaders believe the share of CBM gas in India’s natural gas basket.