THIRD ROUND OF DSF AUCTION LAUNCHED

ISSUE OF NIO: JUNE 10, 2021

BID SUBMISSION CLOSING: OCTOBER 29, 2021

32 contract areas comprising 75 discoveries on offer

11 contract areas are located onshore, 20 in shallow-water and one in deep-water.

Oil and Gas have been already discovered in these fields by ONGC, Oil India, and other oil companies.

In the previous two bid rounds, the Government has successfully awarded 54 contract areas.

These Discovered fields carry a lower risk with higher returns.

However, the economics will depend more on the value of the biddable parameters put in their bids by the investors and entrepreneurs.

Our Services includes:

Assessment based on the Data Room Visit, Field Information Report, and Data available from other sources.

Screen the fields based on 50 techno-economic parameters and rank the fields through our scientifically developed Composite Scores

Do detailed due diligence of the short-listed fields

Review the baseline production under Business-As-Usual (BAU) scenario.

Technical Assessment of the incremental production scenario

Techno-Economic Feasibility including estimating Capital Cost, Cash Flows, IRR, and NPV.

Pin down to some contract areas with our recommendations consistent with the business model of the prospective bidder(s).

Suggest the optimum range for biddable parameters

Provide all professional support in the bidding process in bid preparation and submission.

Respond to queries, if any raised during the bidding process.

LOCATION OF DISCOVERED SMALL FIELDS ON OFFER UNDER ROUND III

Prospects and challenges for the second round of bidding for Discovered Small Fields*

After the successful award of 30 clusters of Discovered Small Oilfields last year, the Government of India has come out with the second round of auction of 25 more discovered areas. The online bidding started on 3rd September and will close on the 18th of December 2018.

In this round, the 59 discovered oilfields have been clubbed in 25 contract areas: 15 onland and 10 offshore. The fields have Initial In-place volumes of 190 MMT oil and oil equivalent gas (1390 million barrels).

These fields were discovered by the national oil companies (NOCs) such as Oil and Natural Gas Corp (ONGC), Oil India Ltd (OIL), and also by others, but not developed so far. These discoveries could not be monetized due to various reasons such as isolated locations, the small size of reserves, high development costs, technological constraints, fiscal regime, etc. It is now planned to put them on production within the next three to four years by making clusters and awarding through the present competitive bidding route on the liberalized terms.

The contracts will be under the new Hydrocarbon Exploration License Policy (HELP) and the winners will get the oilfields with lots of concession to improve the techno-economic viability of marginal fields.

First, there is no signature, discovery, or production bonus. The contractors will not have to make any payment to the ONGC or OIL against the exploration expenses incurred by them in past. Moreover, the assets created at the site such as production facilities and development/ production wells by the NOCs will be handed over to the Contractor without any payment. There will be also no carried interest by National Oil Companies or State participation.

Second, the contractors get full right under a single license for the entire contract duration to explore and produce both conventional and unconventional oil and gas resources, including coal bed methane, shale gas, and oil and gas hydrates with the pricing and marketing freedom.

Third, the contract is based on a simple revenue-sharing model replacing the complex and controversial cost-recovery model. It removes micro-managing the activities by the Government. It is likely to ensure faster decision-making and speedy project implementation. The contractor will give a committed percentage share of revenue to the Government as offered by the contractor while bidding.

Fourth, there are no pre-qualification criteria for prior experience in exploration and production. This gives an opportunity to the entrepreneurs from non-oil sectors, looking for diversification into the Oil & Gas sector by acquiring ‘Discovered Fields’.

Fifth, as many of the blocks offered are located in the vicinity of the existing operating fields of NOCs, the contractors may use their existing processing, transportation, and other facilities on a rental basis. This will reduce Capex and Opex and also expedite monetization of the fields.

These changes make participation in DSF bidding more attractive. However, there are some challenges both for the entrepreneurs and the government.

First, as stipulated in the contract, the oilfields are to be brought into production within three years of the award of onland fields and four years for offshore fields. A speedy environment and other statutory clearance would be needed. Some fields need a fresh 3D seismic survey, data acquisition, processing, and interpretation. Most of the fields require drilling additional development and appraisal wells. The fields would need capital investment to be mobilized on a fast track, for drilling wells and field development to extract hydrocarbon. Bringing oil and gas to the surface within three years requires concerted efforts of the promoters and the government.

Second, though discovered fields do not carry exploration risk, ultimate recovery volume remains uncertain. Unlike earlier contracts in NELP, the new contracts under HELP do not allow cost recovery of capital and revenue expenses before sharing revenue. A committed percentage of actual production has to be passed on to the Government, irrespective of the fact whether the company is making a profit or loss. Therefore, the bidders need to be cautious, rather conservative, while deciding on biddable parameters: percentage of Government Revenue share and commitment for the number of wells to be drilled. Both carry high financial risks.

Third, considering the complexity of oil exploration and production technology, it would be advantageous for new players to rope in other E&P companies and prefer consortium/ joint venture route, a popular structure in the oil industry to share high risk and reward. In the hydrocarbons industry, oil and gas assets are typically owned and operated by unincorporated joint ventures.

In short, the Discovered Small Oil Fields Bidding may prove to be a stepping stone for the promoters for entry into the oil & gas sector, and the country’s wells lying idle start producing oil and gas. India has success stories of small fields turning big, such as Ravva Oil Field in the KG Basin.

* TRUSTWORTHY’s Article as published on ET Energy World on September 3, 2018.

India awarded 23 contract areas to 11 bidders.

India had received an overwhelming response to DSF Bid Round II; 145 bids for 24 oil and gas discovered areas. Chinnewala Field in Rajasthan saw a huge response with 17 bids, followed by Sanganpur Oilfield in Gujarat. The response received in this round is more overwhelming than that even in the previous round in 2016. 39 companies participated in the bidding, which includes 6 foreign companies from the US, the UK, Australia, Singapore and the UAE.

Vedanta Cairn submitted the largest number of bids; it placed bids for 21 discovered small fields out of 25 put on auction. The state-run ONGC and OIL India also competing for 10 blocks each, besides 3 other PSUs- IOC, GAIL and BPRL. As many as 28 domestic private sector companies are also in the race. Some of them are new entrants into the oil and gas industry.

Biding for Discovered Small Field Round-II closed on 30th January. 25 contract areas having 59 Discovered Oil & Gas Fields with 1400 million barrels of oil and oil equivalent gas were on offer.

Discovered fields' contracts on Liberalized Terms

The contracts for Discovered Small Field are covered under the new liberalised policy ‘ Hydrocarbon Exploration Licensing Policy (HELP)’. The contractors get full right to explore and produce oil & gas and all other types of hydrocarbons during entire contract period. The contractors will not need separate license for CBM, Shale Oil etc.

Another paradigm shift is from complex cost revenue model to simple revenue sharing with the Government. In earlier NELP regime, the profit sharing led to delays and disputes with the government scrutinizing cost details of private participants. In the revenue sharing contract, the contractor will not have to obtain government approval for incurring expenses. It will reduce administrative burden and ensure faster decision making and speedy project implementation.

Other incentives include no cess on the oil production, moderate royalty structure and customs duty exemptions. The contractors would also have complete marketing and pricing freedom for the sale of produced crude oil and natural gas to customers of their choice at arm’s length price.

India Launched Discovered Small Fields Round-II on 9th August, 2018

With the success of the first bidding round of Discovered Small Oil and Gas Fields last year, the second round of auction of discovered fields has been launched. The bidding process has started and will close on the 18th December, 2018.

In Round II, the 59 discovered oilfields have been clubbed in 25 contract areas: 15 onland and 11 offshore. The fields have Initial In-place volumes of 190 MMT oil and oil equivalent gas (1390 million barrels)The DGH Data Room has been opened for viewing and interpreting available technical field-data. Bidding starts next month.

These fields were discovered by the national oil companies such as Oil and Natural Gas Corp (ONGC) and Oil India Ltd (OIL) but are yet to be developed. There will be, however, no carried interest by National Oil Companies or State participation.

As the oil and gas is already discovered in these fields, there is less exploration or production risk. This gives a good entry point for the entrepreneurs, new to the oil industry. The eligibility criteria does not require any prior experience in oil and gas industry.

In the first round, the government had put 67 fields and an overwhelming response was received from investors with 134 bids. And 44 fields were awarded in March 2017.

Trustworthy Advisors offers its expert services to DSFs post award

Techno-economic evaluation based on the DSF contractual and fiscal terms

Preparation of Field Development Plan (FDP) including production profile, appraisal and development wells, and production facility

Detailed analysis of all Geological, Geophysical and Well data including interpretation of 2D/3D seismic data, well logs, Production data, Reservoir Studies & Dynamic Simulation etc.

Planning & Quality control of any additional surveys, if required, for optimal development of field and evaluation of any upside potential

Field Development including Drilling & Completion of Wells, Process Platform Construction

Coordination with Oil Field Service providers

Hand-holding till commencement of Commercial Production and thereafter

Planning for Enhanced/Improved Oil Recovery

SUCCESS STORY OF DSF ROUND I

- Contract awarded & signed on fast track, within 10 months in March 2017.

- 20 companies successful won contracts for 30 areas, of which 15 were new entrants.

- Petroleum Mining Lease (PML) already granted to 23 contract areas.

- Field Development Plan (FDP) of a third of the contracts prepared/ approved.

- Some contract winners found reserves much higher (two to five times) than earlier estimated.

- Some Fields to go into production within a year, others in next two- three years.

- Oil production of 15,000 barrel per day and gas production of 2 mmscm per day at the peak expected from 30 awarded fields.

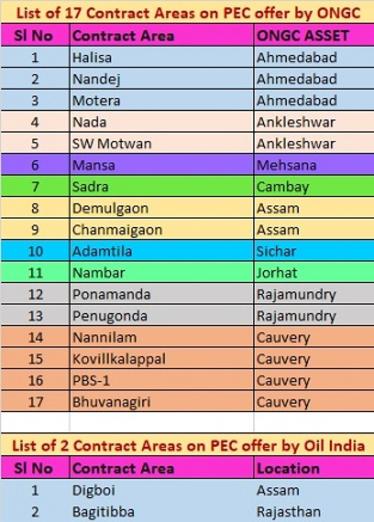

ONGC AWARDS 49 MARGINAL FIELDS

ONGC awards 49 marginal fields to seven bidders. The new operators are expected to bring in new technology and capital to raise output from these mature fields. The enhanced-production will be shared between ONGC and the private operators.

ONGC had invited bids for 64 fields clustered in 17 contract areas with 300 million tonnes of oil & gas reserves. 12 companies had made 28 bids for 14 clusters, covering 50 fields.

These 49 awarded fields span across 13 contract areas in four states: Gujarat, Tamil Nadu, Andhra Pradesh and Assam.

The contract will be for 15 years with an option to extend by 5 years. The contract also includes the right to explore all kinds of hydrocarbon. The operators will also get additional incentives on achieving production higher than the committed incremental production.

ONGC OFFERS 64 MARGINAL FIELDS

ONGC, India’s largest oil and gas producer announced Notice Inviting Offer (NIO) seeking partners for its 64 marginal nomination fields. The objective is maximizing recovery from these fields by infusion of new technology and the enhancement of oil and gas production.

The offer shall allow interested companies to participate in the International Competitive Bidding (ICB) process announced for 17 onshore contract areas comprising of 64 oil and gas producing fields with total in-place O+OEG volume of about 300 MMTOE.

Companies, either alone or in consortium or joint ventures, may bid for one or more contract areas. The bidders are required to fulfil the requisite technical and financial criteria and the bids would be evaluated on the basis of revenue sharing from the incremental oil and gas production.

Bidders interested in studying the data can purchase field information dockets and data packages. Interested companies can access the data viewing facility at Institute of Reservoir Studies (IRS), ONGC, Ahmedabad.

Salient features of the ONGC offering:

Complete marketing and pricing freedom to sell oil and gas on arm’s length basis through a competitive basis.

The contractor will be selected on a revenue sharing basis. The revenue will be shared on incremental production over and above the baseline production under Business-As-Usual (BAU) scenario.

The contract period of 15 years with an option to extend by 5 years.

Reduction of 10% in the royalty rate for additional production of natural gas over and above BAU scenario.

Easy to administer Revenue Sharing model-based contract.

Exploration permitted during the contract period including the right to explore all kinds of hydrocarbon.

Contractors will not be required to reimburse any expenses already incurred by ONGC.

Based on the feedback received from the industry, ONGC further relaxed some of the terms production enhancement contracts for its 64 oil-producing fields.

The new operators are expected to bring in new technology and capital to raise output from these mature fields and will get a share of the enhanced production.

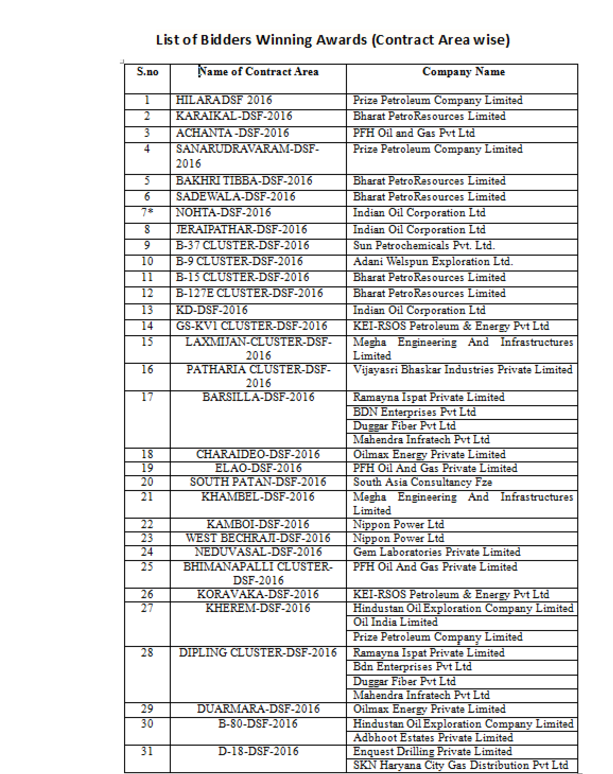

44 Discovered Small Fields Awarded in DSFs Round-1

The Government of India has awarded 44 Discovered Small Oil & Gas Fields (Clustered in 31 Contract Areas) to 22 companies under the new liberalized policy on 15th Feb. All contracts except for one contract area have been signed. Out of 30 Contract Areas signed, the Petroleum Mining Lease (PML) has been already granted to 23 contract areas (16 onshore and 7 offshore). Field Development Plan (FDP) of some of the contract areas have also been approved. The field works are likely to start this year and production to commence in next two-three years. Oil production of 15,000 bpd and gas production of 2 million standard cubic meters per day at the peak is expected from the small fields awarded in the first round.

The government had put 67 fields discovered by ONGC and Oil India but not developed so far. The response from the investors was overwhelming with 134 bids. However, 23 fields could not be awarded that include 20 offshore fields for which no bids were received and three onshore fields for which no bids were found valid. The Government is likely to come out with the next round of auction of some more discovered fields soon. The discovered fields are estimated to hold together over 650 Million Barrels of Oil and Oil Equivalent Gas in-place reserves and likely to add 2% to the country’s oil production.

Discovered Small Fields: Updates since May, 2016

The Government of India awarded 44 Discovered Small Oil & Gas Fields to 22 companies under the new liberalized policy.

Last year the Government of India had put 67 discovered fields, clustered into 46 contract areas, on auction. The discovered fields are estimated to hold together over 650 Million Barrels of Oil and Oil Equivalent Gas in-place reserves. The estimated recoverable reserves are of the order of 220 Million Barrels, around one-third of in-place reserves. They possess trapped resources worth $11 billion at current prices. These fields were discovered by National Oil Companies (ONGC and Oil India). But these discoveries could not be monetized due to various reasons such as isolated locations, small size of reserves, high development costs, technological constraints, fiscal regime etc. It is now planned to put them on production within next three years by awarding through the present competitive bidding route.

The fields were accordingly put on to competitive bidding last year. A series of roadshows were organized at the global oil cities- Houston, Calgary and Aberdeen and also at commercial centres at London, Singapore and Dubai to attract foreign investment into its discovered small oil and gas fields. Within India, the roadshows were held at Delhi, Mumbai, Guwahati and Bangalore.

Though the turnout at the roadshows were good, initially there were apprehensions of poor response to actual bidding for these small and marginal fields especially as the timing of auction was not favourable to oil industry with low oil price. Based on feedbacks from interactive meets, significant relaxations in the bidding norms were made while biddings were in progress. The following changes made the current bid round more attractive.

First, the eligibility condition of bidder’s net worth at least matching with biddable value of work programme was removed. The Bank Guarantee of equivalent amount could be furnished in lieu of this.

Second, the winning bidder will not have to pay any amount for wells and facilities already existing at the well sites or within the field. These fields were discovered by ONGC and Oil India after extensive seismic surveys and drilling of exploratory and appraisal wells. The Government decided to offer the discovered fields to the contractors without seeking any reimbursement of expenses incurred till date on exploration or development of field and also without any upfront signature bonus for the value addition done by ONGC or Oil India. There will be no carried interest by National Oil Companies or State participation.

Third, as many of the blocks offered are located in the vicinity of the existing operating fields of NOCs, their existing facilities may be used by the winning bidder by paying service charges as already notified by the Government. . This will reduce capex and opex and also expedite monetization of the fields.

Fourth relaxation related to waiver of requirement of submission Field Development Plan including in-place reserves, ultimate reserves, production profile, development wells, production facility, additional appraisal to be undertaken, etc. along with the bid.

These relaxation made the fields more attractive resulting in 134 bids for 47 fields in 34 areas. While one or more bids were received for all onland areas and 8 offshore areas, no bidder came forward for 12 offshore contract areas covering 20 fields. None of Oil Majors operating in India such as BP, Shell or India’s largest oil companies such as ONGC and Reliance showed any interest in these fields. But many other private oil companies viz. HOEC, Oilmax Energy, Adani Welspun Exploration, and Sun Petrochemicals emerged successful bidders. Cabinet Committee on Economic Affairs (CCEA) gave its approval to award contract in 31 contract areas covering 44 fields – 28 onland and 16 offshore.

Another significant breakthrough was interest shown by the entrepreneurs from non-oil sectors, looking for suitable opportunities to diversify into Oil & Gas sector by acquiring ‘Discovered Fields’. As oil & gas has already been found in these fields, these blocks do not carry exploration risk. One can straight way develop and bring into production with a low capital investment, ranging between $5 million and $10 million. This can be a stepping stone for entry into large oil & gas sector, hitherto being seen as preserve of only large players. This bid round has seen 37 such new entrants, of which 15 have won the contract.

Considering the complexity of oil exploration and production technology, it would be advantageous for new players to rope in other E&P companies and prefer consortium/ joint venture rout with, a popular structure in oil industry to share high risk and reward. In the hydrocarbons industry, oil and gas assets are typically owned and operated by unincorporated joint ventures.

40 MMT oil and 22.0 BCM of gas in place is to be monetised over a period of 15 years. The successful bidders would have to start production of Oil/Gas within three years, as stipulated in the contract. Speedy environment and other statutory clearance would be needed. Some fields need fresh 3D seismic survey, data acquisition, processing and interpretation. Most of the fields require drilling additional development and appraisal wells. The field would need capital investment, to be mobilised, for drilling wells and field development on fast track to extract hydrocarbon. Bringing oil and gas on the surface within three years, say by 2019 end, is a challenge both for the promoters and the government.

12 private companies bid to operate ONGC's 50 small producing fields.

The new operators are expected to bring in new technology and capital to raise output from these mature fields.

The enhanced-production will be shared between ONGC and the private operators.

The operators will also get additional incentives on achieving production higher than the committed incremental production.

The contract will be for 15 years with an option to extend by 5 years.

The contract also includes the right to explore all kinds of hydrocarbon.

ONGC had invited bids for 64 fields clustered in 17 contract areas.

These fields have a total in-place O+OEG volume of about 300 MMTOE.

12 companies have made 28 bids for 14 clusters, covering 50 fields, and no bids received for 3 clusters covering 14 fields.

The bidders are Duganta Oil and Natural Gas, Orissa Stevedores, Priserve Infrastructure, Udayan Oil Solutions, Oilmax Energy, Deep Industries, Dravida Petroleum DMCC, Syndicate Trading, Shivam Crusher, LNG Bharat, Hermes Technologies, and Advent Oilfield have placed their bids.

The winners will be decided on the Highest Present Value of ONGC sharing of the enhanced production profile quoted by the bidders.